Detailed Notes on Fee-only Investment Advisor

A Money Advisor is an expert who gives specialist advice on managing funds and creating educated economic conclusions. These advisors present A variety of services, which include financial commitment management, retirement scheduling, estate arranging, tax strategies, and chance administration. Their aim is to help consumers achieve their economic targets and create a safe financial potential.

Vital Responsibilities of Financial Advisors

Expenditure Administration

Financial Advisors aid purchasers build and take care of investment portfolios tailor-made to their possibility tolerance, financial objectives, and time horizon. They supply tips on asset allocation, diversification, and investment decision approaches. By repeatedly checking sector conditions and adjusting portfolios as necessary, they goal to enhance returns even though taking care of possibility.

Retirement Scheduling

Scheduling for retirement is a critical services provided by Financial Advisors. They assist clients in figuring out just how much to save for retirement, selecting appropriate retirement accounts, and selecting investments that could improve after some time. Additionally they aid clientele produce withdrawal strategies to make sure that their retirement savings past in the course of their retirement several years.

Estate Organizing

Monetary Advisors do the job with purchasers to build complete estate designs that define how assets are going to be distributed on Demise. This consists of building wills, trusts, together with other legal files. Additionally they deliver information on minimizing estate taxes and making sure that beneficiaries are specified correctly.

Tax Approaches

Minimizing tax legal responsibility is a crucial factor of monetary arranging. Financial Advisors support clients recognize the tax implications in their economic conclusions and create tactics to reduce taxes. This might contain tax-effective investing, retirement account contributions, and charitable offering procedures.

Threat Administration

Protecting assets is critical, and Economical Advisors assist consumers evaluate their insurance wants and choose ideal protection. This includes existence insurance plan, health and fitness insurance coverage, disability insurance policies, and very long-time period treatment insurance. Advisors make sure that clientele are adequately safeguarded in opposition to unforeseen functions that can impression their money very well-staying.

Great importance of monetary Advisors

Personalised Money Strategies

Fiscal Advisors generate customized economic ideas according to person client requires, aims, and situation. These tailor-made ideas provide a roadmap for acquiring money aims, supplying customers a transparent path to adhere to.

Expertise and Know-how

With their comprehensive information of monetary marketplaces, expense products, tax legislation, and estate organizing procedures, Fiscal Advisors provide important insights that men and women may not have by themselves. Their expertise can help customers make educated decisions and prevent frequent economic pitfalls.

Relief

Controlling funds may be advanced and stress filled. Monetary Advisors give peace of mind by taking up the obligation of financial organizing and administration. Clients can truly feel self-confident that their funds are being dealt with by industry experts, permitting them to target other components of their lives.

Lengthy-Phrase Romance

Financial Advisors frequently Create very long-time period relationships with their customers, constantly working with them as their fiscal predicaments and plans evolve. This ongoing partnership ensures that financial ideas stay pertinent and powerful after some time.

Picking a Money Advisor

When picking out a Economical Advisor, it can be crucial to consider their skills, working experience, and rate composition. Hunt for advisors that are Accredited, have an excellent popularity, and provide transparent rate preparations. It is additionally useful to decide on an advisor who focuses on areas applicable on your economic requirements.

In summary, Fiscal Advisors Engage in a vital purpose in supporting people and people realize their economic goals. By furnishing skilled guidance and individualized fiscal ideas, they guideline consumers through the complexities of taking Fee-only Investment Advisor care of their finances, guaranteeing a more secure and prosperous fiscal long term.

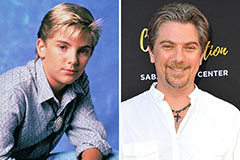

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!